Setting sail in a startup

You stumble across something new in the course of your research. It solves a problem in a way no one else has. You can imagine it someday becoming a breakthrough treatment or ubiquitous lab tool. How do you proceed?

There are many ways to commercialize research; most require much less investment than becoming an entrepreneur. But sometimes an academic believes in their research so much — or sees such significant future value in it — that they take the plunge to found a company.

Some of those entrepreneurs, many of whom have kept their jobs as professors, spoke to ASBMB Today about their experiences and tips for the process.

Intellectual property and the value proposition

Any result of research at a university, commercially useful or not, belongs to that university.

Technology transfer offices handle the patenting of unpublished academic discoveries (see “ How to patent an antibody”) and own the invention — but the inventor can license it. Payment for a license can come in many forms.

According to a 2017 analysis by Hervé Lebret, who manages grants for academic entrepreneurs at a Swiss university, some institutions will accept equity in the startup, others negotiate for royalties from the eventual sale of a product and some will sell a license for a lump sum.

Kevan Shokat is a professor at the University of California, San Francisco and a successful business founder. His most recent, Revolution Medicines, works develops cancer drugs. Cindy Chew/UCSF

Kevan Shokat is a professor at the University of California, San Francisco and a successful business founder. His most recent, Revolution Medicines, works develops cancer drugs. Cindy Chew/UCSF

In the biotechnology sector, Lebret noted, “A raw idea is worth virtually nothing, due to an astronomical risk factor.” The risk is that the idea will fail before becoming a product; the long process of proving that a concept will work as a profitable product often is called “de-risking” or risk mitigation.

The process starts with determining what market need a discovery or invention meets.

Its value may be in proving a concept. Kevan Shokat’s first company is a good example. Shokat, a professor at the University of California, San Francisco, launched a startup called Intellikine to commercialize kinase inhibitors discovered in his academic lab.

In 2006, Zachary Knight and colleagues in Shokat’s lab reported that they had developed isoform-specific inhibitors for phosphatidylinositol-3-kinase, or PI3K, which is involved in growth signaling and was a tantalizing target for cancer treatments. There are many PI3K isoforms; broad-spectrum inhibitors block them all to varying degrees but are toxic. The series of molecules Knight and colleagues developed were highly selective for certain PI3K isoforms.

With Knight, former student Yi Liu and a fourth scientist named Pingda Ren, Shokat founded a company that initially was aimed at selling rights to develop the screened kinase inhibitors to other drug companies. That idea didn’t interest investors, who argued that the company would never recoup its costs by selling risky early-stage molecules. Taking that feedback, the founders decided to develop a small subset of their inhibitors themselves rather than pitching them to other companies.

In that incarnation, after several years of research, Intellikine was a huge success. In fact, it was bought for $190 million. Since then, Shokat and his lab have garnered a reputation for “drugging the undruggable,” delivering another proof of concept with the first inhibitor of KRas, another cancer-causing signaling protein.

The value proposition is what a company offers and customers want to buy. In Shokat’s case, it was proving that a single PI3K isoform or a GTPase could be inhibited without doing harm. A therapeutic index, also called a drug’s safety ratio, is calculated by dividing the dose that causes toxicity over the effective dose. If it is low, a drug may be risky to administer and difficult to develop.

“Nothing is as good a predictor of whether a target is druggable with therapeutic index as having a pharmacological target validation,” Shokat said.

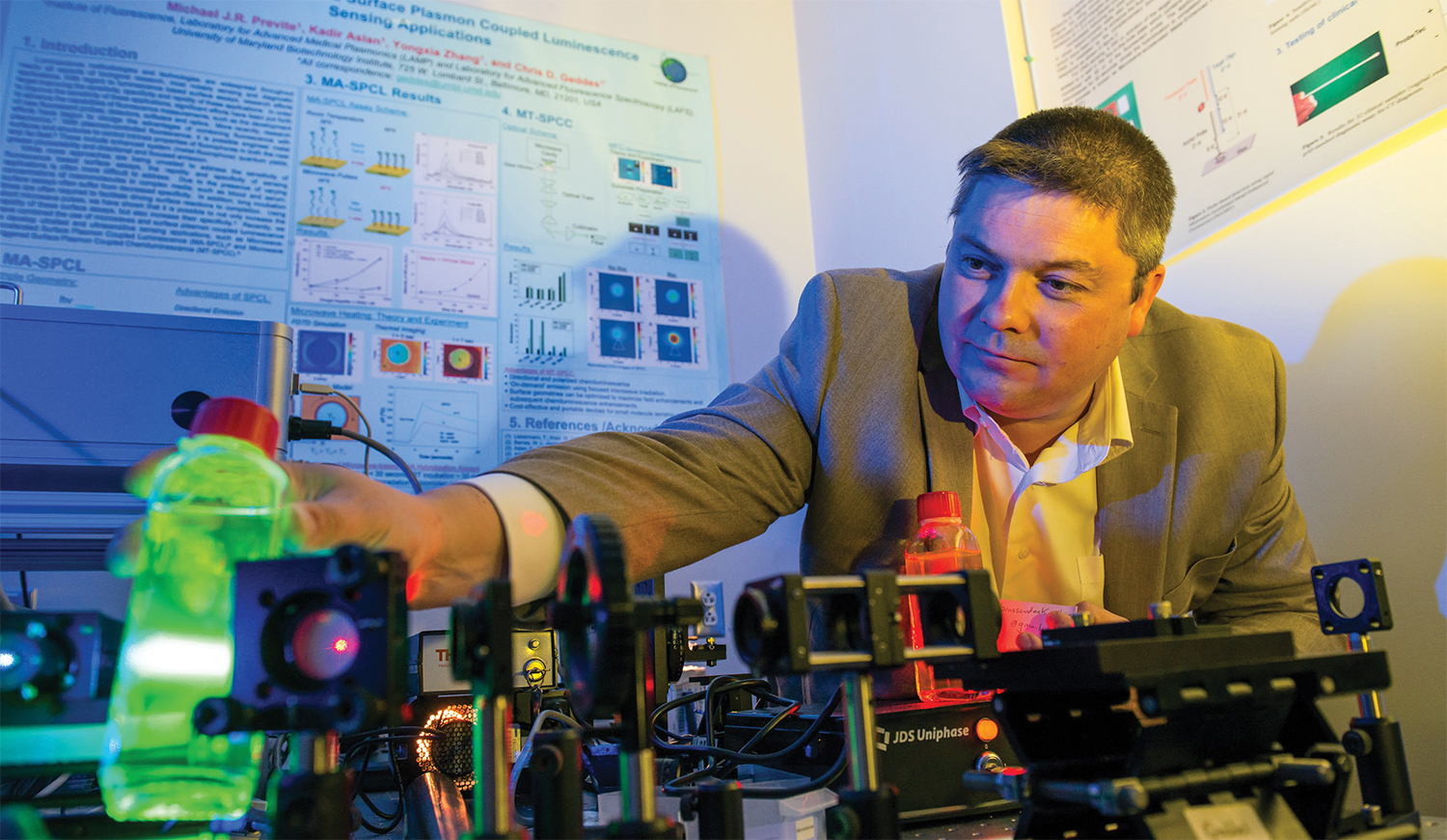

Chris Geddes, a professor of chemistry and biochemistry at the University of Maryland, Baltimore County,has developed more than 300 products as an entrepreneur. Courtesy of Chris Geddes

Chris Geddes, a professor of chemistry and biochemistry at the University of Maryland, Baltimore County,has developed more than 300 products as an entrepreneur. Courtesy of Chris Geddes

Corporate structure and the business strategy

Founding a company involves choosing a business structure, registering for licenses and tax identification numbers, and much more. Many university technology transfer offices offer help to scientists new to these processes.

Rob Woods, a professor at the University of Georgia, is also president of a company he co-founded with Lori Yang based on their academic research collaboration.

Rob Woods, a professor at the University of Georgia, is also president of a company he co-founded with Lori Yang based on their academic research collaboration.

“Science has a complicated language and so does business,” said Rob Woods, a professor at the University of Georgia. “From a scientist’s perspective, if somebody’s talking about ROI, you’re going, ‘What’s ROI?’ I used to go and Google after every meeting.” (ROI stands for “return on investment.”)

Woods co-launched his first business when he was a college student. He got a small-business loan and filled his first-floor apartment with fish tanks. He and a friend raised tropical fish to sell to local pet stores.

The summer taught Woods that aquaculture wasn’t for him. “I got out by breeding black veil angelfish that were as big as plates,” he said. “They were spectacular … (and) made us enough money that I could pay off the loan.”

Lori Yang is chief scientific officer and acting CEO at Lectenz Bio. “Sometimes, researchers are intimidated by carbohydrates,” she said. “We’re trying to make accessible tools.” Courtesy of Lori Yang

Lori Yang is chief scientific officer and acting CEO at Lectenz Bio. “Sometimes, researchers are intimidated by carbohydrates,” she said. “We’re trying to make accessible tools.” Courtesy of Lori Yang

In 2007, having become a full professor at UGA’s Complex Carbohydrate Research Center, Woods founded a company with research collaborator Lori Yang. Lectenz Bio, which develops tools for complex carbohydrate analysis, has proved much longer-lasting than Woods’ fish business. Still, those youthful summers selling fish and working in construction helped him see small business as feasible, Woods said. “A lot of academics have only ever been academics.”

Woods, still working at the CCRC, became the company’s president, while co-founder Yang left her role as a research scientist to become chief scientific officer. “There were a lot of things I didn’t know and had to learn on the fly,” Yang said.

Books like “Startups for Dummies” and other resources helped both Woods and Yang bridge the gap.

Sometimes, researchers can split their time between the roles of professor and CEO successfully. Christopher Geddes, a serial entrepreneur who is also a professor of chemistry and biochemistry at the University of Maryland, Baltimore County, has done it repeatedly.

Marquita Qualls is a chemist turned leadership coach. She was a corporate strategist before launching her consulting business. Courtesy of Marquita Qualls

Marquita Qualls is a chemist turned leadership coach. She was a corporate strategist before launching her consulting business. Courtesy of Marquita Qualls

“That coexistence is very unique to university professors,” said Geddes, who has developed some 300 products. “The University of Maryland allows us to consult up to 20% of our time on outside projects.”

But Marquita Qualls, a leadership coach who has worked with many new entrepreneurs, warns that some academics lack the communication skills to connect with possible investors. “It’s your idea, but when you get ready to turn it into a business, you may not need to be the CEO,” she cautioned. “You may need to find someone on your team who can speak well and present well to represent your company.”

Whatever the infant company’s leadership structure, the leaders must develop a business plan. Developing an invention into a product can be costly. A business plan that lays out the market niche and competitors, summarizes the company’s operational plan, and explains its financial needs is key to landing seed funding. On the other hand, investing too much time in the plan at the expense of managing the company can be a pitfall.

“People spend a lot of time writing out a plan,” Qualls said. “But the implementation of the plan is what’s most important.”

Some inventions, like Yang and Woods’ reagents, fit into a market primarily as tools for research, while others show promise as treatments for disease. Development of the two kinds of product often is funded in different ways.

The money

The function of a startup is to de-risk its technology by proving it can work as a product. As a potential product gets less risky, it becomes more valuable. In many routes to funding startups, the business owners exchange a share of that possible future value for the capital they receive from investors.

In biotechnology and pharmaceuticals, small companies assume tremendous risk; a paper last year estimated that more than 86% of drug candidates that make it to clinical testing in humans are not approved; countless drug-development projects end before making it to the clinical trials phase. Nonetheless, the possibility of a payout attracts attention from investors such as venture capital firms. Such was the case for Intellikine, which secured $41 million in venture capital to fund medicinal chemistry and preclinical studies before its eventual buyout.

To persuade venture capitalists to invest, a company’s founder or CEO presents a product idea and a business plan. Professional analysts at or contracted by the venture capital firm investigate the company and determine whether it seems like a good investment. If it does, then the parties negotiate an exchange of equity for capital. This sometimes is called dilutive funding because it reduces the founder’s stake in the company.

In the world of research tools and products, which are generally less lucrative than pharmaceuticals, companies often secure seed money through nondilutive funding such as government small-business and technology-transfer grants.

Kory Hallett, a program director at the National Cancer Institute’s SBIR Development Center, encourages potential small business grant applicants to talk to a program officer first and “always be ready to resubmit.”

Kory Hallett, a program director at the National Cancer Institute’s SBIR Development Center, encourages potential small business grant applicants to talk to a program officer first and “always be ready to resubmit.”

Kory Hallett handles such grants as a program director at the National Cancer Institute’s Small Business Innovation Research, or SBIR, Development Center. By congressional mandate, federal agencies that fund research must set aside a percentage of their total budget to fund small businesses. That money is disbursed through the SBIR and small business technology transfer, or STTR, grants, which differ in whether they permit collaboration with academic labs. The funds are available from the departments of Defense, Energy, Health and Human Services; NASA; and the National Science Foundation.

In the 2018 fiscal year, the National Institutes of Health awarded some $504 million in SBIR and STTR grants. Applications are peer-reviewed and competitive; success rates hover around 20% each year. During an American Society for Biochemistry and Molecular Biology webinar on small-business grants, Hallett urged attendees to talk to a program officer before submitting an application. The NCI and a few other institutes have rolled out an applicant assistance program.

“Always be ready to resubmit,” Hallett said. “The majority of people have to resubmit at least one time before they are successful.”

For the successful applicant, early-stage SBIR awards, designed to support proof-of-concept research, offer up to $250,000 in funding. Phase II, designed to support the beginning of a commercialization plan, is capped at $1.7 million. Grantees are also eligible for training and professional-development programs, and making it through peer review confers a certain prestige. Pamela Marino, a program officer at the National Institute of General Medical Sciences, said she sees companies advertise their grant status “like a badge.”

Some entrepreneurs come to small-business grant funding after realizing that the research they want to pursue doesn’t fit neatly into the NIH’s R01 funding model.

For example, Woods and Yang, who were working on computational models of protein-glycan binding, decided it was time for a change in their research direction from describing to designing glycan-binding proteins. Woods said, “As we went down this path, it wasn’t leading to hypothesis-driven science; it was really leading to tool development. And tool development is much more suited to small business grants.”

Similarly, Don Jarvis spent years characterizing glycoprotein production in insect cells, which often are used to produce recombinant proteins. After characterizing the differences between insect and human glycosylation, Jarvis led his lab at the University of Wyoming in a project to humanize insect cell glycosylation by stably introducing glycosyltransferases and other enzymes. By the time the system reliably was producing humanized glycoproteins and Jarvis began to submit grant applications to cover work on optimizing the yield, study sections had come to see his work as too applied.

Don Jarvis and his graduate student, Christoph Geisler (not pictured), founded the company GlycoBac after Geisler won an entrepreneurial competition at the University of Wyoming. Ted Brummond/UW Photo Service

Don Jarvis and his graduate student, Christoph Geisler (not pictured), founded the company GlycoBac after Geisler won an entrepreneurial competition at the University of Wyoming. Ted Brummond/UW Photo Service

“At that point, we had proved the principle and done some refinement,” Jarvis said. But the experiments he now was proposing weren’t the kind of basic science that R01 grants are designed to fund. “As an academic exercise, this became stale.”

Pamela Marino, Jarvis’ program officer at the NIGMS, suggested after an unsuccessful R01 application that Jarvis might consider applying for business funding. “This is the kind of grant that will fly through an SBIR study section,” she recalled telling Jarvis.

“I was resistant,” Jarvis said. “In my generation — I trained in the ’70s and ’80s — the notion that you could commercialize your scientific discoveries was not so popular. … It took me nearly losing my academic grants before I realized she was absolutely right. I needed to move that aspect of our research out of the academic setting.”

An extra boost to launch a company arrived when doctoral student Christoph Geisler won a campus entrepreneurial competition for a proposal linked to his thesis research in Jarvis’ lab. The award included $10,000 in seed money and a free year in the University of Wyoming’s business incubator. Jarvis launched the company GlycoBac that year with Geisler as its first employee.

Places, people

Jarvis negotiated with the University of Wyoming to rent space for GlycoBac adjacent to his academic lab. “It’s a beautiful environment,” he said, “because we have students who are exposed to translational research at the same time as they’re being trained in academic research.”

GlycoBac’s situation is unusual, however. In many departments, space is tight, and the arrangement poses some conflict-of-interest risks. Often, an academic spinoff’s first home will be in a business incubator on the university campus. Incubators rent lab space and frequently offer training and services, such as human resources management, to promising new businesses.

Lectenz Bio, Woods and Yang’s company, has sites in both co-founders’ hometowns of Athens, Georgia, and San Diego. Both branches started out in incubators, run by the University of Georgia and the pharmaceutical company Johnson & Johnson, respectively. But the branches faced very different prospects for growing out of the two incubators.

In the Georgia branch, Woods said, “We’ve run out of space in our incubator, and there’s nowhere to ‘graduate’ to in Athens.” Turning the available warehouse and retail space into a lab would require heavy investment in infrastructure such as biohazard disposal, freezers, centrifuges and other equipment. “It’s a big expense to jump from where you are to where you’d have to be,” he said.

On the other hand, Lectenz Bio’s San Diego branch had a variety of lab space rentals to choose from when it outgrew its incubator.

A startup’s location can affect more than the available lab space; it also dictates the available workforce. And hiring, many entrepreneurs say, is key to a company’s success.

“There’s sort of a cliché or received wisdom, especially among young biochemistry faculty members, that running the lab is similar to running a small business,” Geddes said. “It’s not, really. Yes, you’re building a team. But the objectives are so different.”

According to Qualls, an effective team needs a communicator to speak for the company, a technical expert, a go-between who makes sure they understand one another, and — a category she says many startups overlook — a market researcher who can do competitive analysis and due diligence, helping the company understand its position and unique selling points.

In addition to technical skills, entrepreneurs also recruit based on personal characteristics like drive and commitment. Balaji Sridhar, who co-founded a Colorado startup called Nanoly with a friend during his Ph.D., is particularly sensitive about recruiting. Nanoly, which makes a hydrogel that stabilizes proteins, attracted attention when it launched in 2013 touting the technology as a possible means to produce vaccines that would not need refrigeration. Sridhar still believes in that mission, but for regulatory reasons, introducing new chemistry into vaccines has not gone as quickly as he and his co-founder first envisioned.

“You want to find people who are loyal, who are committed to the mission of the company and not just looking for a paycheck,” Sridhar said.

Tough decisions

A startup’s founders must determine whether an invention can become a marketable product. Key decision points along the way usually are laid out in the business plan, which may include a proof-of-concept stage and a development stage. Proof of concept means demonstrating through experiment or prototype that the concept is feasible. Development is making it a better product.

Early on, a company may have several candidates for development; because time and money are finite, it cannot pursue them all. This happened at Intellikine; the company owned three promising kinase inhibitors but lacked the money to fund early clinical trials for all three. After weighing all the data they had collected, the company’s leaders decided in 2011 to license one of the molecules, a PI3K gamma/delta inhibitor, to another biotech company, Infinity Pharmaceuticals.

Nearly a decade later, after several subsequent licensures and near misses, that molecule, duvelisib, became the only one of the three that has made it to the clinic. It’s now sold as Copiktra for patients with leukemia. But when Intellikine’s leadership team was faced with deciding how to proceed, there was no way of knowing how the multiyear process of testing, chemical tweaking and clinical trials would turn out.

“If (small companies) have got multiple assets like we had, a lot of times, there’s a real debate,” said Shokat. Which of the assets is the best bet? Should one be sold off to fund the development of another?

“You’re trying to decide of the three cards you have, which one are you going to put the money down to turn it over?” Shokat said. “It’s a really hard choice.”

A small company’s flexibility

Though Don Jarvis’ company, GlycoBac, was launched to optimize and commercialize a glycoengineered insect cell system, its most lucrative product so far doesn’t come directly from that project. Instead, it builds on an opportunity the team saw and quickly acted on.

At a 2013 conference Jarvis attended, Food and Drug Administration virologist Arifa Khan presented her finding that many insect cell lines used to produce therapeutic molecules were contaminated with a hitherto undetected virus. It was an alarming reminder of the unknown pitfalls that the relatively new field of biologics manufacturing had to confront.

“This is going to have an impact,” Jarvis told GlycoBac’s staff of two, Geisler and Ajay Maghodia, after he returned from the conference. “I expect the FDA won’t just ignore it.”

He challenged the team to come up with an approach to engineer a virus-free line. All three of them, he said, independently came up with the same concept, and Maghodia started to develop an approach to eliminate virus from established insect cell lines.

The project was a commercial success: In 2018, Millipore Sigma licensed the technology, which it now sublicenses as its first insect cell line product.

“We were a glycoengineering company,” Jarvis said. “We had no business creating a virus-free cell line; a board (of directors) would have said, ‘What are you guys talking about? You can’t do that!’”

But with no board to answer to, the team had freedom to try the project — a freedom Jarvis cherishes. “I like to say we’re a PT boat circling around the Titanic. (We can) do whatever we want, right? There will be potentially bad decisions, and there could be decisions that are so bad they take the company down. But in a small biotech company, you get to take those risks.”

The killer experiment

Maybe a risky project costs too much and doesn’t deliver results. Maybe a pivotal experiment gives conclusive, disappointing results. Maybe the target customers aren’t as interested as the inventor had hoped. It’s not a popular topic in entrepreneurial circles, which prize perseverance and valorize the successful founder who makes it big. But the truth is, most startup companies fail; estimates range from 70% to 90%.

“Businesses fail for two fundamental reasons. The first is because they run out of money,” Geddes said. “But the second most important is they make a product nobody wants.”

Balaji Sridhar co-founded the Colorado startup Nanoly, which makes a hydrogel that stabilizes proteins. Courtesy of Balaji Sridhar

Balaji Sridhar co-founded the Colorado startup Nanoly, which makes a hydrogel that stabilizes proteins. Courtesy of Balaji Sridhar

Though data specific to life science startups are scant, broader analyses back Geddes up. The consulting firm CBInsights surveyed post-mortem reflections from 101 shuttered startups across industries and reported that 29% ran out of funds and 42% discovered there was no market need for their product.

Biotechnology companies face another stumbling block: whether the science works the way founders hope it will. According to John Janczy, head of research and development at Nanoly, careful experiments are the best way to face this challenge.

“You have to design what I call killer experiments that will tell you very quickly: Is this idea going to work?” Janczy said. For example, Nanoly’s hydrogels can preserve complex molecular structures; the team briefly considered extending the technology to living cells as well but scrapped the idea after a “killer experiment” failed.

As in academic science, discipline and intellectual honesty are important, Janczy and his CEO, Balaji Sridhar, said. It can be disappointing, but if the data say no, that’s the answer.

“There’s a line between being gritty and being crazy,” Sridhar said. “You have to step back and say, ‘OK, does this really work?’”

If the answer is truly no, Sridhar added, he looks for opportunities wrapped in that no.

The exit strategy

Steve McKnight, a former president of the ASBMB, has started a number of companies. The most recent, called Peloton, developed small molecules to inhibit the transcription factor hypoxia-inducible factor 2 alpha as a treatment for cancer. In five rounds of fundraising, the company raised more than $200 million from investors, and its drug met the desired endpoints in a preliminary safety and efficacy trial. To fund a final, large-scale efficacy trial in patients with renal carcinoma, the company planned to sell equity on the stock market in the spring of 2019. According to Fierce Biotech, the hope was to raise some $150 million.

A company’s entry to the stock market, or initial public offering, often is regarded as a payout; founders and early investors recoup their capital and the added value of a de-risked product. It’s an exit strategy for investors. But Peloton’s was forestalled at the last minute when Merck bought the company for $1.1 billion. The larger corporate buyout is another common exit.

After a startup weathers the possible failure points and comes through with a marketable product — or a plausibly promising drug candidate — in hand, its time as a startup may be nearing an end. Some successful companies have stayed privately owned. But many eventually either are acquired by a larger company or go public.

This can be a huge reward for the founder; it’s often also a decision point in their career. Occasionally, a founder stays with a company throughout its growth. But the skills needed to keep a large business growing are different from those needed to launch one. More often, successful entrepreneurs leave the company; many then start looking for new prospects.

Geddes, the serial entrepreneur, said he’s happiest doing the early-stage work of building a company.

“I often describe myself … as very much a shipbuilder,” Geddes said. “I’ll go out there and find the carpenters, the steel makers and everyone else. We’ll build the ship on the dry dock and we’ll get the financing for putting it together.

“Eventually, a ship will roll off in the water after we broke the champagne on it. After I’ve taken and steered and captained that ship out of the harbor, I believe my role is done.”

Watch the webinar

In the ASBMB webinar, Small Business Research Funding 101, NCI SBIR Program Director Kory Hallett presents funding opportunities and other commercialization resources for small businesses in biochemistry and molecular biology, and Small Business Technology Transfer awardee Sami Kanaan (Chimerocyte) shares his experience as an applicant and an awardee.

Enjoy reading ASBMB Today?

Become a member to receive the print edition four times a year and the digital edition weekly.

Learn moreGet the latest from ASBMB Today

Enter your email address, and we’ll send you a weekly email with recent articles, interviews and more.

Latest in Industry

Industry highlights or most popular articles

Careers in industry: A year in review

Careers columnist Inayah Entzminger looks back at 12 months of interviews, advice and lists of resources.

A brief history of the performance review

Performance reviews are a widely accepted practice across all industries — including pharma and biotech. Where did the practice come from, and why do companies continue to require them?

The molecular biology of commercial cannabis testing

Anthony Torres of Front Range Biosciences, explains how scientists analyze organisms growing on the plant as well as the genetic markers in cannabis DNA.

For this molecular biologist, cannabis testing is a field of discovery

Anthony Torres went from loving high school biology to working in an industry he’s very enthusiastic about.

Upcoming ASBMB events for future industry scientists — and others

ASBMB offers webinars aimed at a variety of member groups, including scientists who have taken time off for caregiving or members who want to start their own labs. These three will be useful to postdocs and graduate students.